Global smartphone shipments continue to sell, while there is pause in India.

Xiaomi continues to ride a tall wave of success as the latest quarterly reports put them in the top five of units shipped worldwide, per a report from Strategy Analytics.

Samsung retained its position as the leader of the market, nabbing a 22 percent share and shifting over 79 million units. “Samsung continued its recovery from last year’s Galaxy Note 7 battery fiasco, lifted by robust demand for the new Galaxy S8 portfolio with an innovative bezel-less design,” notes Neil Mawston, Strategy Analytics Executive Director. “We expect the rumored Galaxy Note 8 upgrade with a bigger screen to further strengthen Samsung in the coming weeks.”

Samsung’s numbers are up 2 percent from Q2 2016, whereas Apple’s share has decreased from 12 to 11 percent, selling 41 million units. “Apple’s iPhone has gone out of fashion in China and this is placing a cap on its worldwide performance. Attention will now turn to Apple’s rumored iPhone 8 introduction later this year and whether its tenth-anniversary flagship model will be different or exciting enough to ignite a rebound in iPhone volumes for the important Q4 2017 Western holiday season,” Mawston commented.

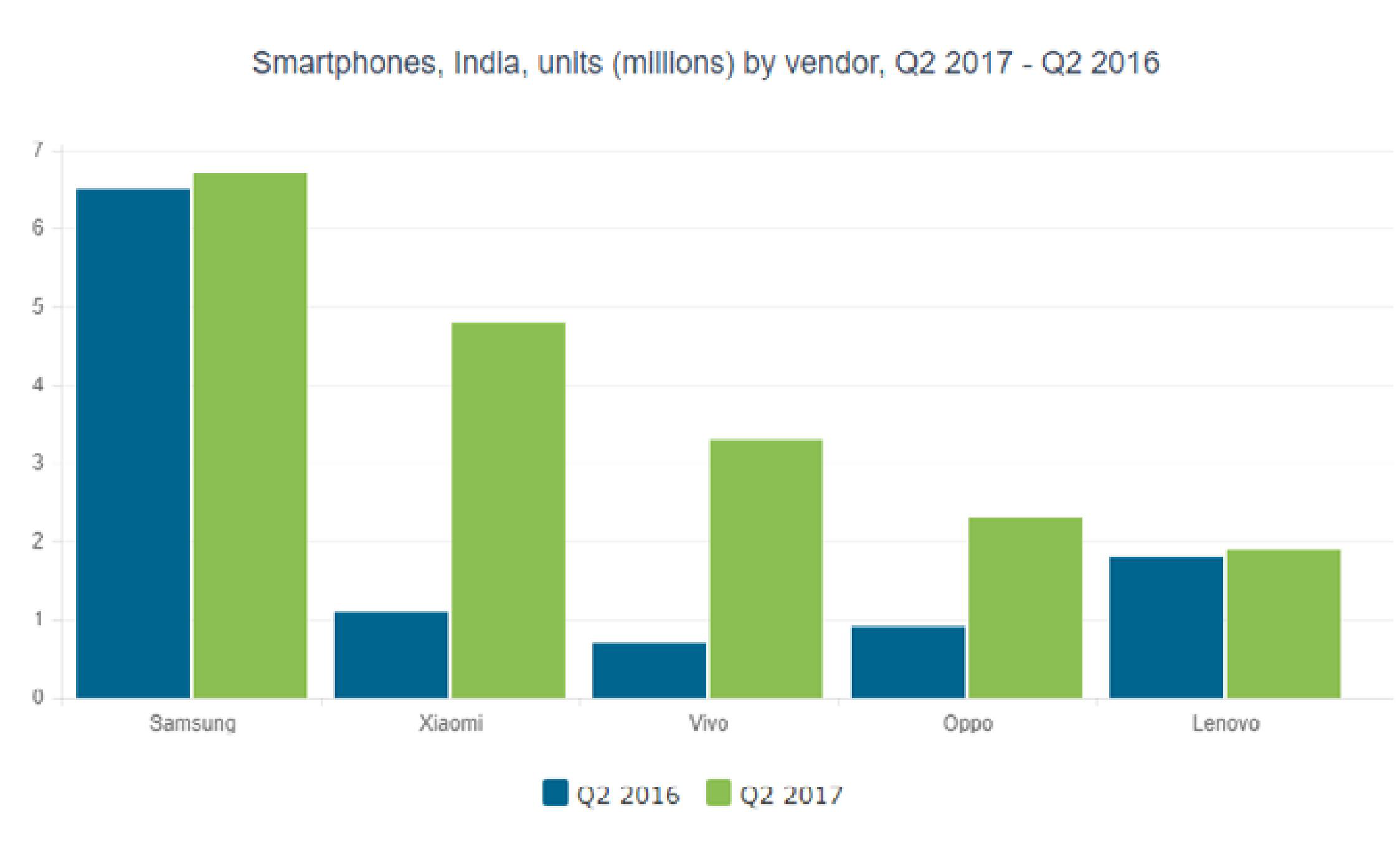

As Apple sees their share decline, Xiaomi eagerly steps in and reclaims the top five spot they lost one year ago. “Xiaomi’s range of Android models, such as the Redmi 4A, is proving wildly popular in India, snatching volumes from competitors such as Lenovo and Micromax,” says Linda Sui, Director at Strategy Analytics. She adds that “Xiaomi has bounced back since ex-Google exec, Hugo Barra, quit the company earlier this year and Xiaomi will be hoping the current momentum can be sustained into the second half of 2017.”

Xiaomi’s products are indeed massively popular in India, with this same report indicating that their sales have made a gigantic year-on-year leap. However, India faces an interesting quandary: overall smartphone shipments have actually declined by 4% since Q2 2016. Daze Info reports that the implementation of a brand new goods and services tax has led to a cut back on production by many manufacturers. However, the new tax could lead to increased sales in the future for two reasons. First, it has bene ted brick-and-mortar smartphone retailers, where many smartphone sales in India are still made. This could give Xiaomi – a company that did not cut back on production during the implementation of this tax – an extra avenue to expand its already-sizable footprint there.

Second, as smartphone manufacturers cut back on shipments of new devices, consumers fell back on purchasing them thanks to confusion as to what the new tax would do to the prices. One of the main purposes of this tax was to clear up discrepancies between state taxes, which would theoretically hasten shipment times in turn. Not only has this happened, but in-store prices have dropped. Both of these conditions are set to unleash both device availability and consumer demand, which will see shipment numbers continue to swell in coming quarters. It is all be certain that 2018’s year-on-year growth will be telling a different story with a happier ending.